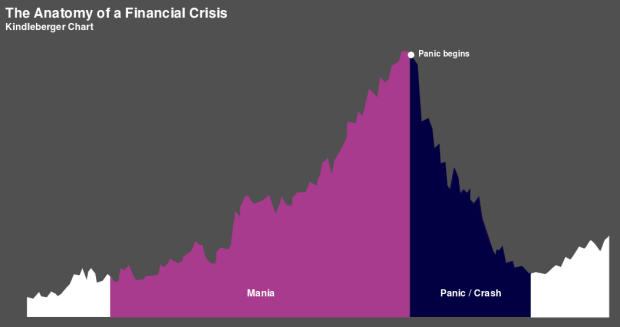

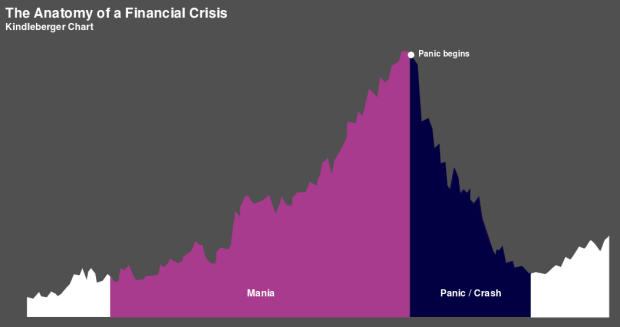

Câteva grafice care explică modul de formare a crizelor financiare.

Acestea derivă și din faptul că sistemul financiar este inerent fragil, fragilitatea care este cauzată în mod fundamental de către structura acestuia.

Câteva grafice care explică modul de formare a crizelor financiare.

Acestea derivă și din faptul că sistemul financiar este inerent fragil, fragilitatea care este cauzată în mod fundamental de către structura acestuia.

Ideas about economic crisis

–> De-globalisation

A multi-year depression will see the frontiers of globalisation rolled back. The market failures exposed by the financial crisis will call into question some of the tenets of the free-market capitalism underlying globalisation.

Globalisation will be blamed for job losses and falling living standards, just as it was blamed for the income and wealth disparities that opened up in the past two decades, even though the ultimate cause for these may lie more in technological advances and failures of corporate governance and regulation.

Governments will respond with protectionist measures in a number of forms. The destruction of excess capacity globally will encourage dumping, which will be used to justify increases in trade tariffs and quotas. In some cases, governments may find it expedient to renegotiate the terms of regional or bilateral free-trade agreements.

In a world of excess capacity where competition for new investment is intense, governments will be tempted to impose restrictions on companies planning overseas investments. High unemployment and social unrest will make labour immigration an even more contentious political issue.

The shrinkage of the financial services industry will curtail crossborder capital flows. Banks that have received public funding will be under pressure to prioritise domestic lending. More generally, the availability of crossborder capital will be constrained in a climate of risk aversion and more onerous capital adequacy requirements.

The days of the freewheeling corporation at the cutting edge of globalisation will be over. When not barred from doing so by protectionism, companies will continue to seek new markets and to achieve cost reductions from offshoring production. But a deep cyclical downturn in emerging markets will lead to a more sober reassessment of their medium- and long-term growth potential. Large emerging-market corporations will face particular challenges given the preponderance of companies in cyclical industries. Emerging-market corporate default rates are likely to exceed those

of their developed counterparts. Aggressive overseas expansion plans hatched by emerging-market companies during the boom years will be scaled back.

–> Kei-Mu Yi, an economist at the Federal Reserve Bank of Philadelphia, argues that trade has fallen so fast and so uniformly around the world largely because of the rise of “vertical specialisation”, or global supply chains. This contributed to trade’s rapid expansion in recent decades. Now it is adding to the rate of shrinkage. When David Ricardo argued in the early 19th century that comparative advantage was the basis of trade, he conceived of countries specialising in products, like wine or cloth. But Mr Yi points out that countries now specialise not so much in

final products as in steps in the process of production.

Trade grows much faster in a world with global sourcing than in a world of trade in finished goods because components and part-finished items have to cross borders several times. The trade figures are also boosted by the practice of measuring the gross value of imports and exports rather than their net value. For example, a tractor made in America

would once have been made from American steel and parts; it would have touched the trade data only if it was exported. Now, it may contain steel from India, and be stamped and pressed in Mexico, before being sold abroad. As a result, changes in demand in one country now affect not just the domestic economy but also the trade flows and economies of several countries.

Prognozele FMI privind efectele crizei asupra Republicii Moldova sunt destul de pesimiste, astfel economia Moldovei în anul curent se va contracta probabil cu cel puţin cinci la sută în termeni reali. Exporturile s-au redus cu peste 20 la sută, remitenţele – cu peste 30 la sută, iar volumul investiţiilor străine directe a scăzut drastic din cauza reducerii activităţii economice în statele din regiune.

Se aşteaptă pe parcursul anului curent o scădere în continuare a cererii interne, alimentate de transferurile private, dat fiind faptul că cererea sezonieră pe piaţa regională a muncii va rămâne probabil joasă.

FMI prognozează o înrăutățire a tuturor indicatorilor,

– astfel impactul crizei asupra economiei locale va duce la o scădere cu 5% pentru anul curent, și o stagnare pentru 2010.

– deficitul bugetar va cunoaște o creștere de mai mult de 10% anul acesta.

– remitențele vor scădea de la 1,860 ( mln dolari) în 2008 la 1,151 (mln dolari) în acest an.

– rezervele oficiale brute scad deasemenea de 1,672 ( mln dolari) pentru 2008 la 1276 ( mln dolari) pentru 2009.

– datoria externa de aproape de 55% din PIB